Are you ready to get out of credit card debt in 2019?By the time you finish reading this post, you'll know exactly how to clear your high credit card balances quickly.

Did you know that your credit card debt is more expensive today than what it was a year ago?

The Federal Reserve has raised its benchmark interest rate four times in 2018 alone, and two more rate-hikes are expected in 2019.

When this benchmark interest rate goes up, within about two months after you can expect your credit card interest rates to also rise.

Struggling to pay your credit cards now? Unfortunately, things are only going to get harder.

Back in 2015, the average credit card interest rate was 15.7%. Today, the average credit card interest rate is 17.6% .

Like anything though, if you can master your debt relief options, debt won't be a problem for you. Use the following guide to help you come with a plan to get out of debt in 2019.

10 Best Ways To Clear High Credit Card Debt

- 1. Debt Snowball Method (best method to get out of credit card debt fast and without falling behind on payments)

- 2. Debt Avalanche

- 3. Balance Transfer Cards

- 4. Home Equity Line of Credit

- 5. How to Negotiate With Bank

- 6. Credit Card Hardship Program with Bank

- 7. Consumer Credit Counseling

- 8. Debt Settlement

- 9. Debt Validation (can be the least expensive way to clear credit card debt and get it off your credit in some cases)

- 10. Bankruptcy

1. Debt Snowball Method:

The debt snowball method is when you pay minimum payments on all of your debts besides for the one with the smallest balance. You're going to aggressively attack that smallest debt first, by putting every dollar that you can get your hands on towards paying it off.

Just like how a snowball accumulates snow and grows in size as you roll it, your monthly available cash-flow will also grow in size after every time you pay off a debt.

After paying off a debt, that debt is now gone. The money that you used to pay towards it, is now available to use towards paying off the next one.

Rather than basing your debt amount on how much you owe on each account or what the interest rate is, instead think about how many credit cards you have. If you have four credit cards, after paying off the first card now you're one-third of the way towards being debt free – even if that first card was your smallest balance!

The fast results that you achieve by paying off your smallest debt first, motivate you to get that next debt cleared. You're seeing that what your doing is working. You are paying off debts one after the other and actually achieving results, and this momentum motivates you to keep going.

This method works by using psychological principles. When a person achieves a goal, like paying off that first credit card debt – the brain releases dopamine, and it feels good. Another benefit of the debt snowball method is that your credit utilization ratio and credit score simultaneously improve each time a credit card balance gets paid in full.

Make a Budget Before Starting the Debt Snowball Method

A useful first step in advance of using this debt snowball approach is to create a budget analysis worksheet, which is basically just putting all expenses in one column and income in another.

A budget will provide you with a visual image of where your money is going, making it easier to find non-essential expenses that can be reduced or eliminated. In the beginning, it's going to be hard to find any extra money at all, right?

(example: lower the electric and heat bill, use coupons when shopping to save money at the grocery store, remove the HBO that you never watch, and cancel that old subscription that you forgot was billing you each month).

2. The Debt Avalanche

The debt avalanche method is similar to the debt snowball method, but the difference with the debt avalanche is that you order your debts by their interest rate. Instead of paying off your smallest balance first, you would pay off the credit card balance with the highest interest rate first, the one costing you the most.

By paying off your most expensive accounts first, you can get out of debt faster and maximize your savings. This option requires more will-power than the debt snowball method because it takes longer to get results, but if you stick it out and use this option to become debt free, you will end up saving more money in the end than if you were to use the debt snowball method.

You may decide to use a combination of the debt snowball and avalanche method, using the debt snowball method to motivate you. For example, pay off all of your balances that are $1,000 or less using the debt snowball method. After quickly clearing these first few small debts and getting that feeling of gratification, then switch to prioritizing your debts by the interest rate and using the debt avalanche method.

At NerdWallet.com they offer an excellent Debt avalanche calculator tool to help you get out of debt faster with this route.

3. Balance Transfer Cards:

“Low Rate Balance Transfers | 0% Intro APR. Apply Now!”

Wow, that’s enticing. … until you read the fine print; “after 12-18 months the introductory rate comes to an end, and the interest rate rises to 19.9%”. Balance transfer cards also come with up-front fees. These fees range from 3%-5% of the amount of credit card debt getting transferred. If you move $10,000 onto a balance transfer card that charges a 4% fee, that’s $400 in up-front costs.

When is a balance transfer card worth it?

- If you can afford to pay the balance “in full” within the 12-18-month introductory period, you could end up paying low to no interest and only a $400 fee. Shop around for a balance transfer card that comes with low costs and only go this route if you can afford to pay the balance in full within the introductory rate period. Use this debt national calculator tool to help you do the math.

- Choose a balance transfer card that pays you high cash back. Bank of America offers a credit card that pays up to 3% cash back. If you transfer $50K in credit card debt onto a balance transfer card that pays you 3%, you'll get reimbursed $1,500 in cash back. Put that $1,500 towards paying off your next credit card debt in line as you continue with the debt snowball method. You can eliminate 100% of interest and earn cash back when using a balance transfer card to pay off high-interest credit card debt.

- Keep your credit card accounts open after paying off the balances. If you close a credit card account, your credit score will decline because your credit utilization ratio will be negatively affected and the length of your credit history will be reduced.

4. Home Equity Line of Credit:

When using a home equity line of credit to pay off credit card debt you’re taking on considerable risk. You’re swapping an unsecured debt for a secured debt. If for whatever reason you can’t afford to continue paying your scheduled monthly payments on the home equity line of credit, you could end up losing your home over a credit card debt, wherein you see the risk.

However, this is still one of my favorite tools for clearing credit card debt. The value of using a home equity line of credit to pay off credit card debt is that you’re eliminating high-interest credit cards, and replacing them with a low-cost home equity line of credit.

According to Bankrate.com , 5.56% is the average interest rate on a home equity line of credit as of May 2018, significantly lower than the average interest rate on a credit card.

5. How to Negotiate With Bank to Reduce Interest Rate

Negotiating directly with your creditor to reduce the interest rate and monthly payment can be a relatively simple and practical option. You may be able to convince a creditor to lower your interest rate permanently.

For example; one of my close friends recently contacted Chase bank and requested that they lower his interest rate.

“I'll be closing my credit card account at Chase and switching to Capital One," he said, "who offered me a 12% rate on a similar card." He continued, "I’ve been a loyal client for six years now, and it would be mutually beneficial for you to lower your interest rate so that I can stay with Chase.” Chase quickly approved the request and permanently lowered his interest rate from 15% to 12%.

All it took was the initiative to make a quick phone call.

Here's a credit card payoff calculator to help you.

6. Credit Card Hardship Program with Bank

In some cases, you may only be able to get a temporary reduction in the monthly payment, but if you’re going through a financial hardship, that may be your best solution.

To be considered for a bank’s credit card hardship program, you must be behind on your monthly payment, but not to the point where your credit report is negatively affected.

Steps to get approved:

- The trick is to call your creditor in 7-10 days after you miss the monthly payment. Late payment history doesn’t get reported to the credit reporting agencies until you’re more than 29-days past due.

- To strengthen your case, send the creditor a copy of your budget analysis, a financial hardship letter and evidence to validate your reason for needing a lower payment, before calling them.

- When calling your creditor, request to speak to a supervisor because they have the authority to reduce your monthly payment. Let the supervisor know that you’re calling to see if they can temporarily lower your monthly payment. Go over the fact that you could not afford to make your last monthly payment and explain why. Include the details of your financial hardship. Make sure to keep your story in line with what you stated in the hardship letter. Also, reassure your creditor that your financial hardship is only temporary and provide an estimate for how long you'll need the relief.

- The supervisor will ask you a series of questions about your income. At that point, verify that they received your budget analysis, hardship letter and whatever documentation you sent.

You’ll be rejected from a bank’s credit card hardship program if your income is too low, due to insufficient income. If your income is too high, they may not consider you to have a real financial hardship. There is no set number, but as a general rule of thumb, consider showing that you could reasonably afford about half of the projected monthly payment that is currently required.

7. Consumer Credit Counseling

After completing your budget analysis, if you find that you only have enough money to make minimum monthly payments or less, you may want to seek a debt relief program. There are several advantages to participation in a debt relief program.

A consumer credit counseling (CCC) plan may lead to lower interest rates and the consolidation of several of your monthly payments into an easier to deal with, more manageable single payment.

It’s common to see 25% interest rates, get reduced to 8%-10%. Consumer credit counseling can lead a person out of credit card debt within 4-5 years, versus 9-15 years when paying minimum payments.

Although participation in CCC has a minimal effect on a person’s credit score, there may be some adverse consequences to consider.

For example, anytime you change the original terms on your credit card contract there’s an adverse effect on your credit rating, and with consumer credit counseling a third-party notation will be notated on your credit report.

8. Debt Settlement Services

If your credit card debt is with a collection agency, debt settlement can reduce the balances to around half, before company fees.

Debt settlement programs can offer a solution to your debt that is affordable, and it provides you with a viable option other than bankruptcy.

Debt settlement services can help a person to pay off all of their unsecured debt in under 48 months.

Negative consequences of debt settlement include:

- Credit scores go down and derogatory notations will appear on credit (including late and collection marks).

- There is no guarantee that a creditor will settle at a certain percentage.

- The IRS could require a person to pay taxes on the amount saved after a credit card settlement .

- Late fees and interest cause credit card balances to increase before getting resolved.

- A creditor could issue a person a summons to go to court, and although this is rare it could happen.

9. Debt Validation

Before signing up for a debt settlement program, consider debt validation . The Fair Debt Collection Practices Act (FDCPA) gives you the legal right to dispute a third-party debt collection account through debt validation, forcing the collection agency to prove that they have the legal authority to collect on a debt.

A recent article in BusinessInsider.com stated; “Billions of dollars in student loans may be wiped out for tens of thousands of borrowers in the US because a lender didn't keep track of the paperwork verifying ownership of the loans.”

When a debt collection company can’t prove, a person owes the debt; the debt becomes legally uncollectible – where the collector must stop collection on the debt and subsequently can no longer lawfully report the debt on a person’s credit report.

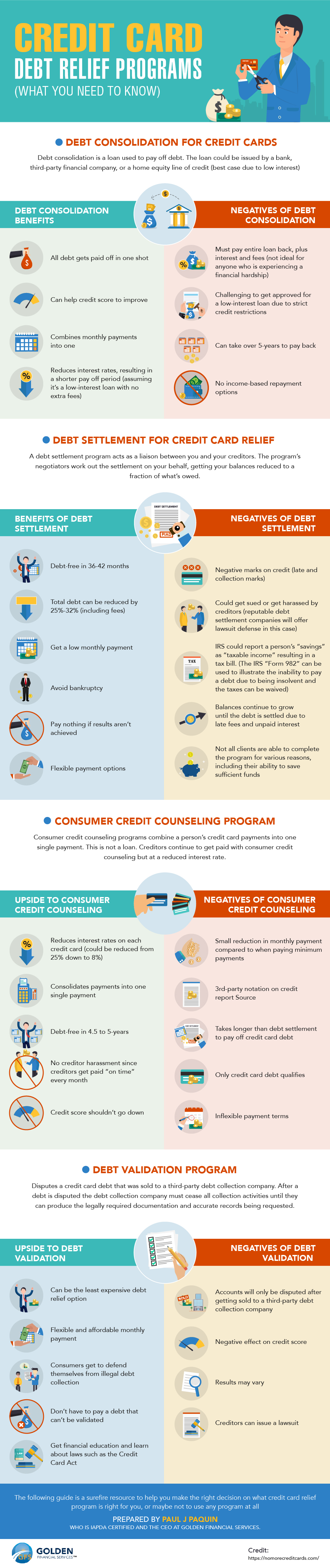

Debt Relief Program Infographic (Pros vs. Cons)

10. Chapter 7 Bankruptcy for Credit Card Debt:

As of September 20, 2018, 62% of all consumer bankruptcy filings were for Chapter 7 bankruptcy.

Why is Chapter 7 the preferred way of bankruptcy?

The reason is that Chapter 7 bankruptcy wipes away credit card debt so that it doesn't have to get paid.

Chapter 7 bankruptcy only lasts for 3-6 months, making this one of the fastest ways to escape credit card debt in 2019.

With chapter 7 bankruptcy (also known as “liquidation bankruptcy”) a debtor’s assets are sold, and the proceeds are used to pay off creditors. However, 95% of debtors do a “no asset filing ” because they don’t have any assets to be sold. If a debtor doesn’t have any assets to get sold, their debts are discharged and no longer legally owed.

Credit cards, private student loans, medical bills, and almost all unsecured debts can get discharged and wiped away clean (excluding federal student loans, tax claims, spousal or child support, condominium and housing fees, alimony, and a few others).

Debts NOT Discharged in Chapter 7 Bankruptcy

The Downsides of Bankruptcy:

- Your credit score can get lowered by 175 points

- Next to each creditor that gets discharged, it will say, “debt discharged due to bankruptcy”

- Potential employers, landlords, and creditors will all be able to see that you filed for bankruptcy

- Credit scores will be subprime after filing for bankruptcy, making it difficult to get approved for low-interest rates on any type of credit

- Premiums on car insurance , cell phone, and insurance monthly payments can all legally increase once bankruptcy goes on a person’s credit report

- Chapter 7 bankruptcy can stay on your credit report for 10-years

Here's a bankruptcy guide to help you learn more about bankruptcy if this is an option you're seriously considering.

About the author:

Paul J Paquin is the CEO of Golden Financial Services, a national debt relief company that specializes in helping consumers achieve financial freedom and credit card relief. Paul integrates his experiences and insights from Golden Financial Services, into his writing, sharing solutions to the everyday financial challenges that Americans face. Paul’s passionate about empowering consumers with the knowledge needed to improve their finances and take control of debt. He’s created numerous guides on debt related subjects; a few of the most popular include, “A Guide to Understanding Unsecured vs. Secured Debt” and “The Ultimate Guide on How to Get Student Loan Forgiveness”.